I remember when I first started helping clients buy homes—everyone told me to wait for the perfect moment, to save more money, to wait for the right neighborhood. Then I watched my first client lose their dream home because they waited too long. That’s when I realized most of the advice out there isn’t just outdated—it’s actively harmful. I’ve been doing this for eight years now, and what I see is that the old school methods of home buying are like trying to drive a car with a manual transmission in a world that’s all automatic. The rules have changed.

Most of the home buying advice you see online still reads like it was written in the 1990s. The truth is, we’re in a completely different market now. Interest rates fluctuate faster than I can say ‘house payment,’ buyers are getting more creative with financing, and neighborhoods that were once considered ‘too expensive’ are suddenly hot markets. My approach focuses less on waiting for the perfect conditions and more on finding the right opportunity in the current landscape. What worked in 2008 or even 2015 doesn’t work anymore. I’m here to tell you what does work now—and what you need to stop doing.

Why Home Buying Advice Is So Outdated

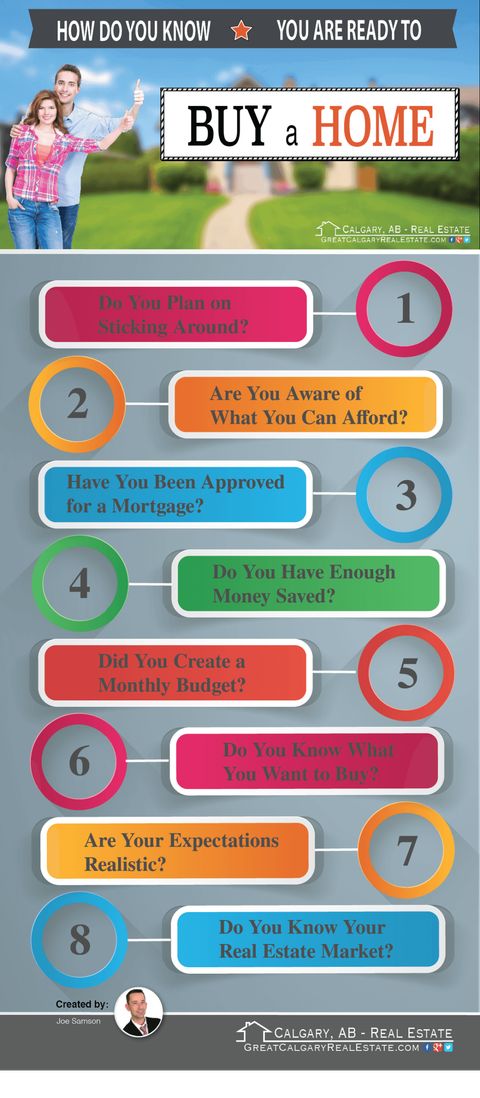

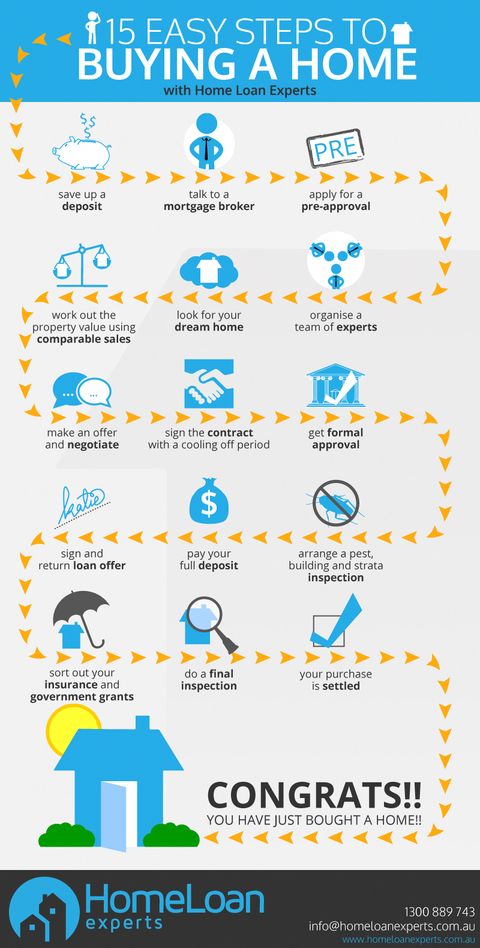

Let me be clear: I’m not saying the fundamentals are wrong. You still want to get pre-approved, understand your budget, and do your research. But the execution has changed dramatically. Here’s what’s different:

• Interest Rates: We’re talking about rates that were unthinkable a few years ago—sometimes even 7%+ for mortgages. That means people who waited for lower rates are missing opportunities.

• Market Speed: The average time on market has dropped to under two weeks in many areas. In my experience, that means you need to move fast or risk losing your target property.

• Buyer Competition: There are more buyers competing for fewer homes, which changes everything about how you make offers. I’ve seen buyers lose deals because they didn’t understand that making a competitive offer is about more than just price.

• Digital Tools: The way we search, negotiate, and close has changed so much that traditional advice often makes you look behind instead of forward.

How I Approach Modern Home Buying Now

Here’s what I do differently when I help someone buy a house now:

Start with a realistic timeline – I don’t ask people to wait until they have perfect savings. Instead, we figure out what they can realistically afford with today’s rates and then plan around that.

Use technology strategically – I’ve built a system using Zillow, Redfin, and local MLS data that helps identify properties before they hit the market. It’s not cheating; it’s just smart planning.

Focus on lifestyle fit, not just price – People are looking for more than just affordable homes. They want walkability, good schools, and future growth potential. I help them find those factors without overspending.

Negotiate smartly – I’ve seen too many clients make their first offer too low or too high. Today, the key is understanding the seller’s motivations, not just offering the highest price. Sometimes a slightly lower offer with strong contingencies wins the day.

Build relationships early – I’ve found that working with a buyer’s agent who understands the local market and has connections with sellers’ agents makes all the difference. It’s not about being pushy—it’s about being prepared.

The Mistakes I Made with Home Buying Advice

Early in my career, I made a big mistake by following the advice I’d heard so many times. I told a client to wait for the ‘right’ time to buy, and they ended up watching their favorite neighborhood become unaffordable within six months. I also pushed too hard for the lowest price, which backfired when the seller had already accepted another offer.

Another client I worked with was so focused on getting the ‘perfect’ house that they missed the fact that their budget wasn’t sustainable. They bought a beautiful home but couldn’t afford the monthly payments, leading to financial stress that could’ve been avoided.

These mistakes taught me that home buying isn’t about following formulas—it’s about understanding the person and the market dynamics. I learned to ask more questions about their goals, not just their numbers.

What Most People Get Wrong About Home Buying

There are several persistent myths that still dominate the advice space, and they’re holding people back:

• You Should Always Wait for the Perfect Price – This is dangerous advice. If you wait for the absolute lowest price, you’re likely to miss the house entirely. In many markets, especially in cities like Austin, San Francisco, and Denver, houses go fast. You want to be ready to act quickly when something comes along.

• Pre-approval Means You Can Buy Anything – Pre-approval is great, but it doesn’t guarantee anything. I’ve seen people get pre-approved for $500k and then spend weeks looking at homes in the $700k range. That’s not how it works. You have to stay within your actual comfort zone.

• More Money Always Equals Better Deals – This is particularly true in hot markets. Sometimes spending more upfront gives you better long-term value. For example, a slightly higher down payment can reduce PMI costs or allow you to avoid private mortgage insurance altogether.

• You Need to Be Perfect Before You Buy – The idea that you need to save every penny before buying is flawed. In fact, buying sooner rather than later can be a smart financial move. You’re locking in your rate, building equity, and starting to build wealth.

Choosing the Right Financing Strategy

One of the biggest shifts I’ve seen is in financing approaches. People used to be told to get the longest term possible to keep monthly payments low. But today, I recommend:

• Shorter Terms When Possible – Even a 15-year mortgage can save thousands in interest over the life of the loan. If you can handle the higher payment, it’s usually a smart move.

• Consider Rate Locks Early – With rates changing rapidly, locking in a rate early can save you thousands. I always advise clients to lock as soon as they’re ready to make an offer.

• Explore Alternative Loan Types – Government-backed loans like FHA and VA loans can give buyers more flexibility. And for those with excellent credit, conventional loans with lower down payments are becoming more available.

• Don’t Ignore Closing Costs – These can add up quickly. Some lenders offer no-closing-cost loans, but they often come with higher interest rates. I help clients weigh both options carefully based on how long they plan to stay in the home.

Frequently Asked Questions About Modern Home Buying

• Should I wait for lower interest rates?

Not necessarily. Rates are unpredictable, and waiting could mean missing out on the home you want. If you’re financially ready, it’s better to move forward now and lock in your rate.

• How do I know if a house is a good investment?

Look beyond the price tag. Consider neighborhood trends, future development plans, and how long the home has been on the market. A house that’s priced well and located in a growing area is usually a solid choice.

• What should I prioritize in my first home?

Your priorities depend on your situation. If you’re young and starting a family, focus on school districts and walkability. If you’re retired, consider proximity to healthcare and amenities.

• How do I make a competitive offer?

Beyond price, include a strong contingency package, a clean inspection clause, and a quick closing timeline. Sellers want to feel confident about moving forward.

• Is it better to buy a new or existing home?

That depends on your budget and timeline. Existing homes are often more affordable and have established neighborhoods. New construction offers modern features and warranties but may cost more upfront.

What You Need to Stop Doing Now

There are several things I wish people would stop doing:

• Waiting for the ‘Perfect’ Market – There is no perfect market. Markets shift constantly, and the best time to buy is when you’re ready and financially prepared.

• Trying to Negotiate Everything – You don’t need to negotiate every single detail. Focus on what matters most—price, timeline, and contingencies.

• Ignoring Local Market Trends – What works in one city may not work in another. I’ve seen clients lose deals because they applied advice from other regions without considering local factors.

• Underestimating the Importance of Location – Price is important, but location is paramount. A house in a good neighborhood with a bit more than your ideal price can be a better long-term investment than a cheaper home in a declining area.

• Not Using Technology – If you’re not using digital tools to search, research, and communicate, you’re leaving money on the table. I use apps, websites, and social media to stay ahead of the game.

The bottom line is that home buying advice has evolved far beyond what most people realize. You don’t need to wait for the perfect moment—you need to be ready for the moment that comes. I’ve helped hundreds of people navigate this changing landscape, and the ones who succeed are the ones who adapt their strategy to match the current environment.

If you’re thinking about buying a home, don’t let outdated advice hold you back. Start with a realistic budget, embrace technology, and work with someone who knows how the market works today—not how it worked five years ago. I’ve seen too many people miss opportunities simply because they followed old-school advice that’s no longer relevant.

Here’s my final piece of advice: Don’t let fear of the unknown keep you from taking action. Buy when you’re ready, not when you think you should be ready. And if you’re unsure where to start, reach out. I’m here to help you navigate this journey with confidence and clarity.